This brief analysis goes deeper into Millenials’ home renovation preferences and funding choices look the way they do based on their Homeowners Renovations Survey and the Generational Renovation data:

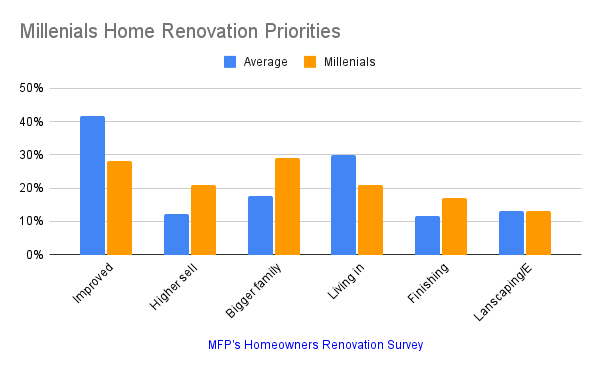

Millenials Home Renovation Priorities

Improved Living: 39%

Millennials show a strong interest in improving their living conditions, just slightly below the average (43%). This could be driven by their desire to create homes that reflect their lifestyles and values, possibly influenced by the trend of home-centric living, especially post-pandemic.

Higher Sell Price: 28%

Millennials are more focused on increasing their home’s resale value compared to Gen Z (16%) but still below Gen X (49%) and Boomers (45%). This suggests that while Millennials are interested in home improvements, they also consider the investment aspect, perhaps planning to upgrade to larger homes or relocate in the future.

Bigger Family: 21%

Millennials prioritize renovations to accommodate a growing family more than any other generation. This aligns with their current life stage, where many are starting or expanding their families, necessitating more space or functionality in their homes.

Living in Longer: 29%

The fact that nearly a third of Millennials prioritize making their homes suitable for long-term living indicates a dual focus: they are investing in homes they plan to stay in, but with an eye on future flexibility, possibly anticipating changes in family size or work-from-home needs.

Room Addition: 21%

Millennials’ moderate interest in adding rooms suggests a balance between needing more space for their families and the cost considerations of such renovations. This could be influenced by the rising costs of construction and their relatively lower disposable income compared to older generations.

Landscaping Exterior: 17%

Their interest in exterior landscaping is on par with the average, indicating that outdoor spaces are important to them, perhaps as an extension of their living area, especially in suburban settings where many Millennials are purchasing homes.

Overall: Millennials appear to balance improving their homes for both personal enjoyment and future resale value. Their focus on family needs and long-term living suggests they view their homes as both a current haven and a future investment.

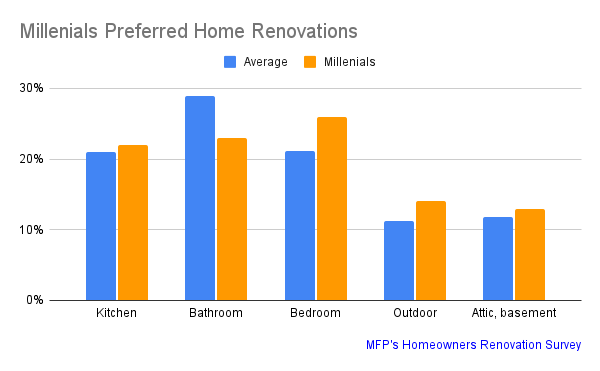

Home Renovations Preferred by Millenials

Kitchen: 22%

Millennials have a higher-than-average focus on kitchen renovations, indicating the kitchen’s role as a central hub in their homes. This may be due to the importance of the kitchen in daily life, from cooking to entertaining, and its impact on resale value.

Bathroom: 23%

Bathroom renovations are also a priority, though less so than kitchens. This could be because bathrooms are seen as essential spaces that contribute significantly to both personal comfort and home value.

Bedroom: 26%

Millennials prioritize bedroom renovations more than any other generation. This might reflect their need to create personal retreats within their homes, possibly driven by the demands of balancing work, family, and relaxation in the same space, especially with the rise of remote work.

Outdoor: 14%

heir higher interest in outdoor renovations, compared to the average, suggests that Millennials value outdoor spaces for recreation, relaxation, and as an extension of their living area.

Attic, Basement: 13%

Millennials’ interest in renovating attics and basements, while modest, suggests they see potential in converting these spaces into functional areas, such as home offices, gyms, or additional living quarters.

Overall: Millennials prioritize renovations that enhance both the functionality and aesthetic appeal of their homes, with a strong focus on the kitchen, bathroom, and bedrooms, reflecting their need for spaces that support their busy, multifaceted lives.

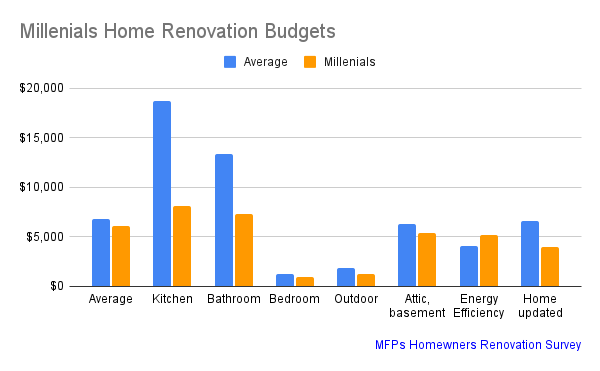

Millenials Renovation Budgets

Kitchen: $8,100

Millennials’ spending on kitchen renovations is moderate, reflecting their emphasis on this space. They might be seeking modern, efficient kitchens that cater to their culinary interests or that are attractive to potential future buyers.

Bathroom: $7,300

Their spending on bathroom renovations, while lower than Gen X and Boomers, indicates a willingness to invest in comfort and convenience. Millennials may opt for upgrades like modern fixtures, energy-efficient appliances, or spa-like features that enhance daily living.

Bedroom: $1,000

Millennials spend relatively less on bedroom renovations, which might indicate a preference for smaller, cosmetic updates rather than extensive overhauls. This could be due to budget constraints or a focus on other areas of the home.

Outdoor: $1,300

Their spending on outdoor renovations is aligned with the average, suggesting that they see value in creating usable outdoor spaces, possibly for entertaining, gardening, or family activities.

Energy Efficiency: $5,200

Millennials’ investment in energy efficiency is slightly above average, reflecting their awareness of environmental issues and a desire to reduce energy costs. This could be influenced by both economic and ethical considerations.

Home Updated: $4,000

Their spending on general home updates is moderate, indicating a balance between maintaining their homes’ current condition and making necessary improvements.

Overall: Millennials tend to spend carefully on renovations, focusing on areas that offer the most immediate value and utility, such as kitchens and bathrooms. Their investments in energy efficiency also suggest a forward-thinking approach to homeownership.

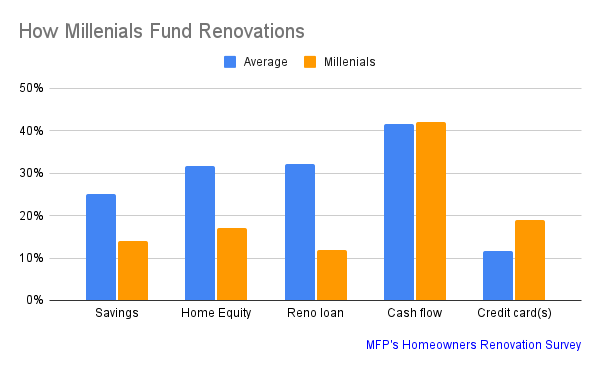

How Millenials Funds Their Home Renovations

Savings: 14%

Millennials’ relatively low use of savings for renovations could be due to several factors: the impact of student loans, the cost of raising families, and the challenge of building savings while navigating economic uncertainty. They may prefer to keep their savings as a safety net rather than deplete them for home improvements.

Home Equity: 17%

Millennials’ limited use of home equity reflects their shorter homeownership period compared to older generations, meaning they have less equity built up to tap into. This could also suggest caution in leveraging their homes’ value, possibly due to lingering memories of the 2008 financial crisis.

Renovation Loan: 12%

Their lower reliance on renovation loans compared to Gen Z could indicate a preference for more manageable, smaller-scale renovations or a cautious approach to accumulating debt.

Cash Flow: 42%

Millennials’ high use of cash flow for renovations suggests that they are managing their renovations through regular income, possibly prioritizing smaller, incremental projects that don’t require large upfront investments. This could also reflect a tendency to live within their means.

Credit Card(s): 19%

The relatively high use of credit cards may indicate a preference for convenience, the desire to earn rewards, or simply the need to finance smaller, immediate expenses. However, it could also reflect tighter budgets or the need to spread out payments over time.

Overall: Millennials’ funding approach highlights a careful balancing act between improving their homes and managing their finances. They seem to prefer using available cash flow and credit for renovations, possibly due to limited savings and equity, while avoiding large amounts of debt.

End Note:

Millennials approach home renovations with a focus on practicality, family needs, and future resale potential. They prioritize spaces that enhance daily living and cater to their lifestyle, such as kitchens, bathrooms, and bedrooms.

Their financial strategies reflect their unique economic challenges and cautious approach to debt, with a preference for using cash flow and credit cards to manage renovation costs.

Overall, Millennials are thoughtful in their renovation decisions, balancing current needs with long-term goals.