This brief analysis goes deeper into Boomers’ home renovation preferences and funding choices look the way they do based on their Homeowners Renovations Survey and Generational Renovation data:

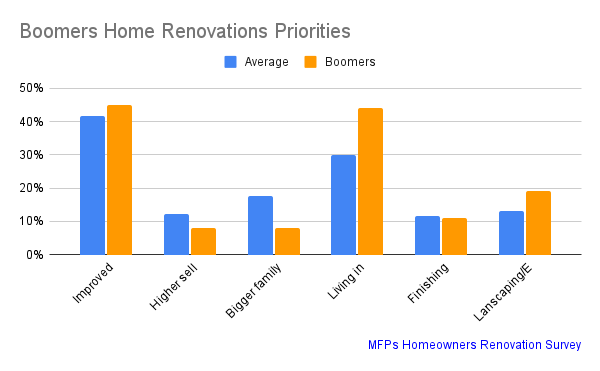

Boomers Home Renovation Priorities

Improved Living: 44%

Boomers place significant emphasis on renovations that enhance their living conditions. As they enter retirement or approach it, many Boomers focus on making their homes more comfortable and suited to their current lifestyle. This could include modifications for aging in place, such as making their homes more accessible.

Higher Sell Price: 45%

A priority on increasing resale value suggests that many Boomers are considering selling their homes in the near future. This generation may be planning to downsize or move to retirement-friendly communities, and they see renovations as a way to maximize their return on investment.

Bigger Family: 8%

The low priority on preparing for a bigger family is consistent with Boomers’ life stage. Most Boomers are likely past the stage of raising children and are instead focused on optimizing their homes for their current needs, such as creating guest rooms for visiting family members or hobbies.

Living in Longer: 8%

The minimal emphasis on living in their homes longer could indicate that many Boomers are planning to relocate, possibly to smaller homes or retirement communities, rather than staying in their current homes. For those who do plan to stay, the focus might be more on making necessary adjustments for aging rather than extensive renovations.

Room Addition: 44%

Boomers show the highest interest in room additions among all generations, which could be tied to creating spaces that enhance their lifestyle, such as adding a home office, a hobby room, or expanding living areas for better comfort.

Landscaping Exterior: 11%

Boomers’ relatively low interest in exterior landscaping might reflect a focus on interior improvements that directly impact their daily lives. They may prioritize practical upgrades over aesthetic changes to the exterior.

Overall: Boomers prioritize renovations that improve their current living conditions and increase their home’s resale value. They are focused on making their homes more comfortable for their lifestyle and ensuring a good return on investment if they choose to sell.

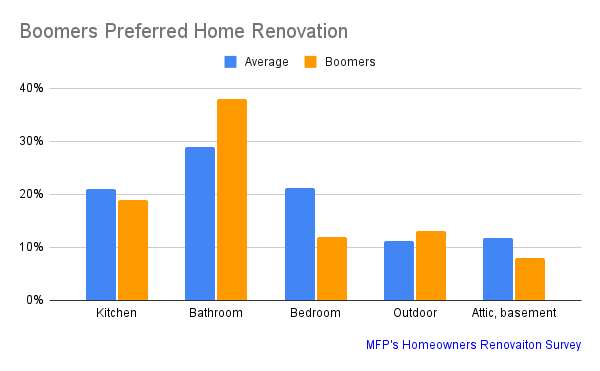

Types of Renovations Preferred by Boomers

Kitchen: 19%

While Boomers value kitchen renovations, their interest is lower than that of Gen X and Millennials. This could indicate that many Boomers have already updated their kitchens or prefer to invest in other areas of the home that better suit their current needs.

Bathroom: 38%

Bathrooms are a top priority for Boomers, reflecting a focus on comfort and accessibility as they age. Renovating bathrooms to include features like walk-in showers, grab bars, and better lighting could be a key concern for this generation.

Bedroom: 12%

The low interest in bedroom renovations suggests that Boomers may already be satisfied with their current bedroom setups or see these spaces as less critical to their renovation goals. They might focus on functional upgrades in other areas of the home instead.

Outdoor: 13%

Boomers’ moderate interest in outdoor renovations reflects a balanced approach to both indoor and outdoor spaces. Enhancing outdoor areas could be tied to creating comfortable, low-maintenance spaces for relaxation and entertainment.

Attic, Basement: 8%

The limited focus on attics and basements indicates that Boomers might prioritize main living areas over spaces that require significant structural changes or are less frequently used. They may prefer renovations that have a more immediate impact on their daily lives.

Overall: Boomers focus on bathroom renovations, likely to improve accessibility and comfort as they age. While they value kitchen upgrades, other areas like outdoor spaces and room additions are also important, reflecting a desire to adapt their homes for a comfortable and enjoyable lifestyle.

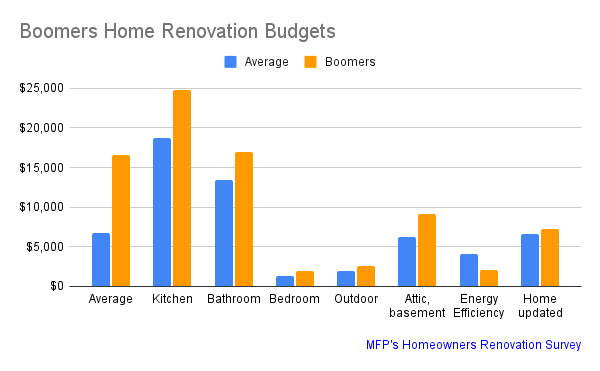

Boomers Renovation Budgets

Kitchen: $24,800

Boomers are willing to invest significantly in kitchen renovations, though less than Gen X. This spending reflects the importance of the kitchen as a functional and social space, even if it’s not their top renovation priority.

Bathroom: $17,000

Boomers lead in bathroom renovation spending, which aligns with their priority on improving comfort and accessibility. They may be installing features that allow them to age in place more comfortably, such as walk-in showers and upgraded fixtures.

Bedroom: $1,900

The lower spending on bedroom renovations suggests that Boomers might focus on more functional upgrades rather than extensive changes. This could involve minor improvements like new flooring or paint rather than major structural changes.

Outdoor: $2,600

Boomers invest more in outdoor spaces compared to other generations, indicating a desire to create comfortable, low-maintenance outdoor areas. This investment might include updating patios, installing walkways, or improving landscaping.

Energy Efficiency: $2,100

Boomers spend less on energy efficiency compared to other generations, which might suggest that they are less concerned with long-term energy savings or that their homes already have basic energy-efficient features in place.

Home Updated: $7,200

The substantial investment in general home updates shows that Boomers are committed to maintaining and improving their homes, ensuring they remain in good condition and potentially increasing their resale value.

Overall: Boomers are willing to spend heavily on key areas like kitchens and bathrooms, prioritizing comfort, accessibility, and functionality. Their spending reflects their financial resources and a focus on making their homes more livable for the long term, whether they plan to stay or sell.

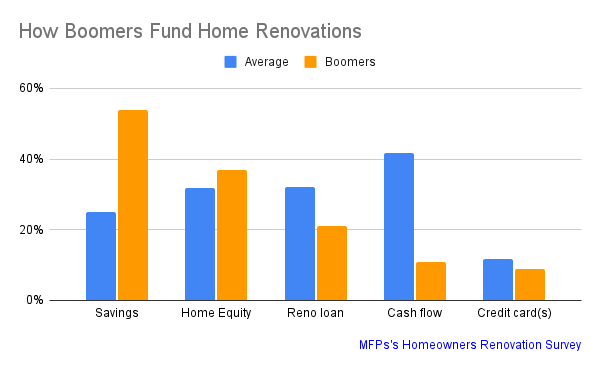

How Boomers Funds Their Home Renovations

Savings: 54%

Boomers predominantly use savings to fund their renovations, reflecting their financial stability and a conservative approach to debt. This reliance on savings indicates that many Boomers prefer to avoid loans or credit, opting instead to use accumulated wealth to finance their home improvements.

Home Equity: 37%

The significant use of home equity suggests that Boomers are comfortable leveraging their home’s value to fund major renovations. This might be due to having substantial equity built up over years of homeownership, allowing them to make larger improvements without impacting their cash flow.

Renovation Loan: 21%

While Boomers prefer using savings and home equity, the use of renovation loans indicates that some are still open to taking on debt, particularly for larger or more immediate projects. This could be a strategic choice to manage cash flow or to fund extensive renovations.

Cash Flow: 11%

The minimal reliance on cash flow reflects Boomers’ preference for using more secure and predictable funding sources, like savings or home equity, rather than relying on regular income to cover renovation costs.

Credit Card(s): 9%

Boomers are the least likely to use credit cards for renovations, which aligns with their preference for using savings and avoiding high-interest debt. This conservative financial approach is typical of a generation that values financial security and stability.

Overall: Boomers prefer to fund renovations through savings and home equity, reflecting their financial stability and conservative approach to debt. Their funding choices highlight a focus on maintaining financial security while still investing in substantial home improvements.

End Note:

Boomers approach renovations with a focus on enhancing comfort and accessibility, particularly in key areas like bathrooms and kitchens. They prioritize renovations that improve their current living conditions and increase home value, preparing their homes either for aging in place or for future resale.

Their financial strategies show a strong preference for using savings and home equity, reflecting their financial stability and a cautious approach to debt.

Related Research